Current Article ∙ Archive ∙ Back to Island Voices

Investment Outlook

March was the best month for global stocks since April 2003 – the first full month of the last bull market. The rally illustrates how quickly the tide can turn and the importance of maintaining exposure to stocks if you hope to capitalize on a recovery. There is no way to know if March was the ultimate bottom until after the fact; however, history has repeatedly shown that the market’s initial recovery is swift and accounts for a disproportionate amount of long-term market gains.

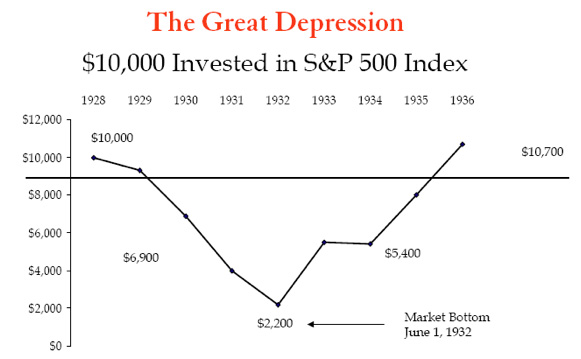

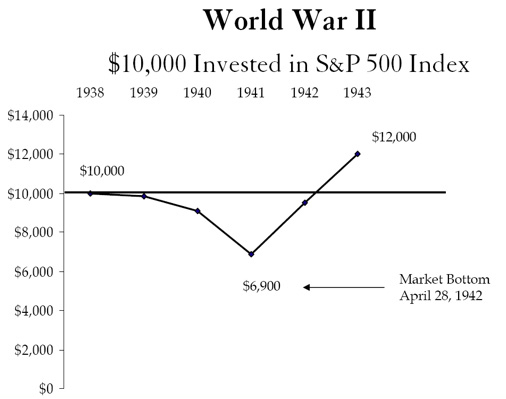

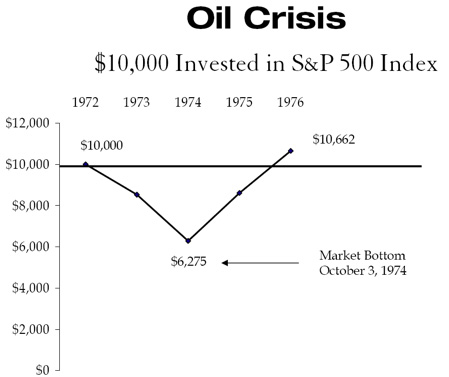

Check out the charts below that were included as part of my How to Handle Bear Markets presentations held Sept. to Dec. 2008:

Investors who sold out at the market bottom realized a loss of 78%. Those who were brave enough to invest benefited from the stock market’s meteoric rise of + 137.6% from June 1, 1932 to May 31, 1933.* And the market continued its meteoric rise until March 6, 1937 with a cumulative return over the period of more than + 300%.

Investors who sold out during WWII realized at loss of 31%. Those who were brave enough to invest benefited from the stock market’s rise of + 64.3% from April 28, 1942 to April 27, 1943* with a cumulative gain over the next two years of more than + 150%.

Investors who sold out during the Oil Crisis realized at loss of 44%. Those who were brave enough to invest benefited from the stock market’s rise of + 44% from Oct. 3, 1974 to Oct. 2, 1975* with a cumulative gain until late 1980 of more than +125%.

* Historical data provided by Alliance Capital and Ibbotson & Associates.

What about INFLATION?

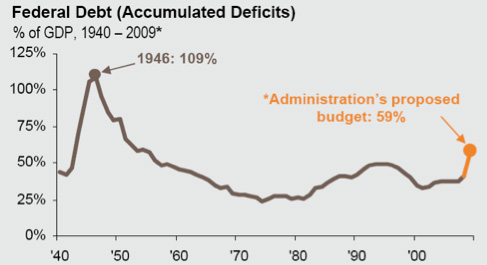

Pundits in the media continue to speculate about the effects of the deficit-induced government debt, but net public debt relative to the size of the economy in both Canada and the US is comparable to or lower than it was from 1933 to 1963 – a period where the global stock markets delivered exceptional gains to investors willing to do their homework and invest wisely.

Source: Congressional Budget Office, St. Louis Fed, Bureau of Economic Analysis, JPMorgan Asset Management. Data reflects most recently available as of 03/31/09.

Concerns about inflation are warranted longer-term with short term interest rates in many parts of the developed world near zero and the fact that central banks in many developed countries have started programs to purchase financial assets like treasury bills and corporate bonds from financial institutions (such as banks) using money it has created. This is known as “quantitative easing” or printing money. The theory is that this new money is supposed to encourage lending thereby reducing the cost of borrowing for individuals and businesses, thereby stimulating the economy.

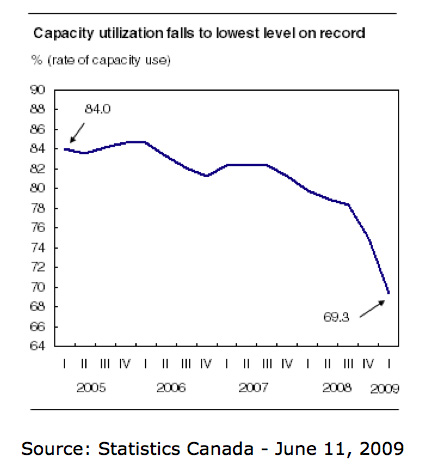

But right now reinvigorating global economic growth is more important than worrying about theoretical inflation concerns of the future since there are three factors that can change quickly and are widely believed to affect inflation: a) price expectations; (b) the pressure of demand; and (c) other factors directly affecting wages and prices. At this point, the capacity utilization rate in most countries around the world is at or near historical lows. Statistics Canada reported that the first quarter of 2009 was the first time that industrial capacity use fell below the 70% level since they started keeping track in 1987. (Capacity utilization measures the relationship between actual factory output that ‘is’ produced by the current equipment and the potential output which ‘could’ be produced if they were operating at full capacity). Add in the lack of pricing power and orders that most businesses are facing means that inflation concerns, particularly in the near-term, are overblown.

The one essential principle behind any comeback, whether on the sporting field, in your career or private life, is a refusal to give up. There’s a lesson here for investors whose retirement plans may be in sad shape after the market slump of the past 18 months. Do not to give up, but rather use this time to assess whether your portfolios are properly aligned, whether the investment mix has stood up in this market and if your advisor isn’t doing a good job of keeping you informed – Now is the perfect time to get a second opinion.

The best financial decisions are based on informed reason, not emotion. If you would like to discuss any of the investments mentioned, or if you have questions about your portfolio or investments in general, please feel free to contact me. As always, I welcome your questions and comments!

© April Dorey. Articles, statistics and other data referred to or cited are intended to provide readers with potentially useful information for their own personal use. *Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Reproduction without permission is permitted with due acknowledgement. The views expressed are those of the author, April M. Dorey, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Raymond James Ltd. is a member of the Canadian Investor Protection Fund.

For more information please contact:

April Dorey, B.Comm, FMA, FCSI

Financial Advisor

Raymond James

10th Floor, 1175 Douglas Street

Victoria, BC.

Tel. 250-405-2429

www.aprildorey.com

Current Article ∙ Archive ∙ Back to Island Voices