Current Article ∙ Archive ∙ Back to Island Voices

How U.S. Estate Tax Applies to Canadians in 2011

On December 17th the American government updated numerous tax rates and laws. For Canadians with US property (referred to as “U.S. situs assets” in most tax publications) such as a vacation home in Arizona, a ski chalet in Vale or U.S. securities you may be subject to U.S. estate tax. This article is not intended to be specific tax advice, but is merely to make you aware of the recent U.S. estate tax changes so that you can identify if you might have an issue that should be discussed in further detail with the appropriate tax professional.

$5 Million Exemption

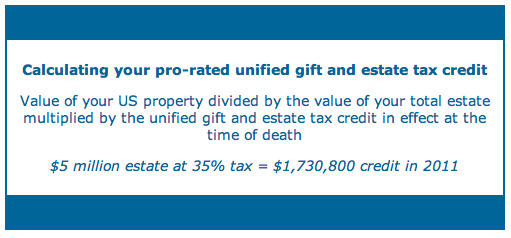

In 2011 the U.S. estate tax was reinstated with an exemption amount of $5.0 million – this means that estates valued at less than $5 million are exempt from estate taxation. Canadians benefit from the same tax exemption amounts that U.S. persons can claim under the U.S.-Canada Tax Treaty, but Canadians must remember that the tax exemption is pro-rated based on the ratio of the value of your U.S. assets compared with the value of your estate as a whole.

Valuing your Estate Under U.S. Rules

Canadians must keep in mind that the value of your Canadian assets and the value of your entire estate is based on the U.S. rules when calculating your U.S. estate tax. For example, Canadians holding life insurance might not think to include the value of this insurance when valuing their estate since the proceeds of insurance are not subject to tax in Canada, but insurance proceeds (like lottery winnings) are subject to taxation under U.S. law. Note that insurance proceeds are included in the value of your estate for U.S. purposes, even if the estate is not named as the beneficiary of the insurance policy.

All non-residents of the U.S. are entitled to a flat $60,000 U.S. tax exemption. This means that if your U.S. assets are worth less than $60,000, even if your estate is valued at more than $5 million, your estate may be free from taxation under U.S. law.

Calculating U.S. Estate Tax

Below is an example of how the U.S. estate tax would be calculated on a Canadian person’s estate. This assumes that the deceased was an unmarried Canadian resident, Canadian citizen and taxpayer who died in 2011 owning a condominium that was worth U.S. $600,000 in Seattle, Washington, USA and that the deceased also had Canadian assets valued at U.S. $5.4 million at the time of his or her death.

Summary of facts:

$6 million total estate value at the time of death U.S.

$1,730,800 Unified Gift & Estate Tax Credit

Single taxpayer

Estate Tax on $600,000 U.S. assets at 35%: $210,000

Less proprated unified credit*

$600,000/$6,000,000 x $1,730,800: ($173,080)

Net U.S. estate tax owing: $36,920

As you can see from this example, the Canada-U.S. tax treaty only provides partial relief where the value of a Canadian’s U.S. property is low in relation to the total value of their estate, but the tax bill it is not nearly as high as some imagine.

Professional tax advice can add real value particularly when you are dealing with cross-border taxation issues. If you would like a referral to an a qualified Certified Public Accountant (CPA) or Estate & Tax Attorney who is experienced in U.S.-Canada taxation please feel free to contact me.

April M. Dorey, B.Comm, FMA, FCSI

T: 250.405.2429 or 1.877.405.2400

april.dorey@raymondjames.ca

www.aprildorey.com

*Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Written by April Dorey and expresses the opinions of the author and not necessarily those of Raymond James Ltd. Statistics and factual data and other information in this newsletter are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. Securities-related products and services are offered through Raymond James Ltd., member CIPF. Financial planning and insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member CIPF. In accordance with privacy legislation, the individuals you are referring must consent to their information being provided to me.

© April Dorey. Articles, statistics and other data referred to or cited are intended to provide readers with potentially useful information for their own personal use. *Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Reproduction without permission is permitted with due acknowledgement. The views expressed are those of the author, April M. Dorey, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Raymond James Ltd. is a member of the Canadian Investor Protection Fund.

For more information please contact:

April Dorey, B.Comm, FMA, FCSI

Financial Advisor

Raymond James

10th Floor, 1175 Douglas Street

Victoria, BC.

Tel. 250-405-2429

www.aprildorey.com

Current Article ∙ Archive ∙ Back to Island Voices