Current Article ∙ Archive ∙ Back to Island Voices

Leaving a Legacy: Will You be Remembered as a Burden?

A simple fact of life is that there are essentially three ways we can die: Sudden Death; Lingering Illness; or Old Age – natural, slow decline. Most of us bet on living healthy, independent and active lives in our own homes until our last breath, but statistics show that in Canada the vast majority of us die slowly often with extended illnesses.

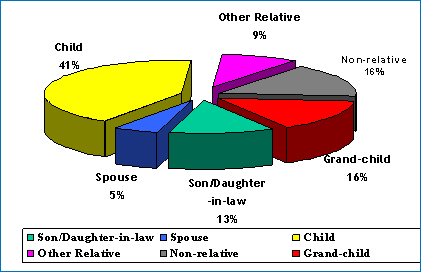

Any type of care, for any length of time, must be paid for. But who provides care to the elderly?

Below is a chart showing statistics from the National Alliance for Caregiving (NAC) & The American Association of Retired Persons and the Family Caregiving Network:

Having the right insurance or solution in place allows your retirement plan to execute for the purpose for which it was intended:

Your Retirement

Retirement funding sources:

1. Your Assets

2. Your Pension and Investment Income*

3. Long Term Care Insurance

Can you afford the cost of care with just those first two resources?

*Will your Power of Attorney keep your portfolio invested, or will you run out of money because they put it in something “safe” like a chequing account? Unfortunately this happens all too often.

Long Term Care Insurance never replaces what families do. Rather, it builds on an existing infrastructure of support thus allowing your family or caregivers to provide you with better care for longer. The provincial governments change their system regularly. Long-term Care Insurance coverage helps you to live comfortably right to the end by providing money for the out-of-pocket expense for home care, assisted care and nursing home care.

The reality is that your long-term care has little to do with you…

- Hiring a companion to visit you daily might be a simple meal preparation or taking you for a walk: Cost per hour $25.50/hr min 2 hrs = $18,615/year.

Now let’s say you need some personal care. The cost per hour $29.00 with a minimum 2 hrs = $21,170/year assuming you wanted 2 hours of care daily.

Independent Living or Assisted Living seniors’ homes cost about $2,300-$3,200/mo or $27,600/year at the low end.

Private long term care homes cost about $5,000=$7,000/month or $60,000-$84,000/year.

24-Hour Palliative care in your home costs about $395/day or $144,174/year. You don’t want your family to be wishing for the end.

If you are interested in learning more about Long Term Care Insurance or applying for this coverage, please feel free to contact me by telephone: 250.405.2429 or e-mail: april.dorey@raymondjames.ca

April M. Dorey, B.Comm, FMA, FCSI

T: 250.405.2429 or 1.877.405.2400

april.dorey@raymondjames.ca

www.aprildorey.com

*Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Written by April Dorey and expresses the opinions of the author and not necessarily those of Raymond James Ltd. Statistics and factual data and other information in this newsletter are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. Securities-related products and services are offered through Raymond James Ltd., member CIPF. Financial planning and insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member CIPF.

© April Dorey. Articles, statistics and other data referred to or cited are intended to provide readers with potentially useful information for their own personal use. *Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Reproduction without permission is permitted with due acknowledgement. The views expressed are those of the author, April M. Dorey, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Raymond James Ltd. is a member of the Canadian Investor Protection Fund.

For more information please contact:

April Dorey, B.Comm, FMA, FCSI

Financial Advisor

Raymond James

10th Floor, 1175 Douglas Street

Victoria, BC.

Tel. 250-405-2429

www.aprildorey.com

Current Article ∙ Archive ∙ Back to Island Voices