Current Article ∙ Archive ∙ Back to Island Voices

About Bonds

Investing is a carefully planned and prepared approach to managing and accumulating money. This issue of Seniors 101 talks about some of the great opportunities we’re seeing in the fixed income market right now.

Investing is a carefully planned and prepared approach to managing and accumulating money. This issue of Seniors 101 talks about some of the great opportunities we’re seeing in the fixed income market right now.

With interest rates so low, non-callable government bonds and corporate bonds with firm maturity dates may be trading at significant premiums to par; this may be a great time to capture that premium by selling the bond. Why now?

- In a low interest rate environment many bonds have appreciated substantially and are trading at high premiums well above their maturity values;

- Government and provincial bonds may be priced at such a high premium that you are guaranteed to earn less than 3% for the remainder of their 3 to 5 year term-to-maturity;

- This premium will disappear as the bonds get closer to maturity since bonds mature at their stated par value. In fact you can actually earn a (Government Guaranteed) negative return in a taxable account on a bond with a high premium as you are paying tax on the coupon not the yield. The loss at maturity is a capital loss and does not reduce the tax on the purported interest income;

- With the flight to safety, you may even be able to obtain a higher rate from a GIC with a comparable term-to-maturity.

Although bonds traditionally are not as actively traded as stocks, opportunities can occur in the market that, at least warrant a review of your investments. You should be very aware of the structure of any bonds as they may vary.

Bonds vs. Bond Mutual Funds

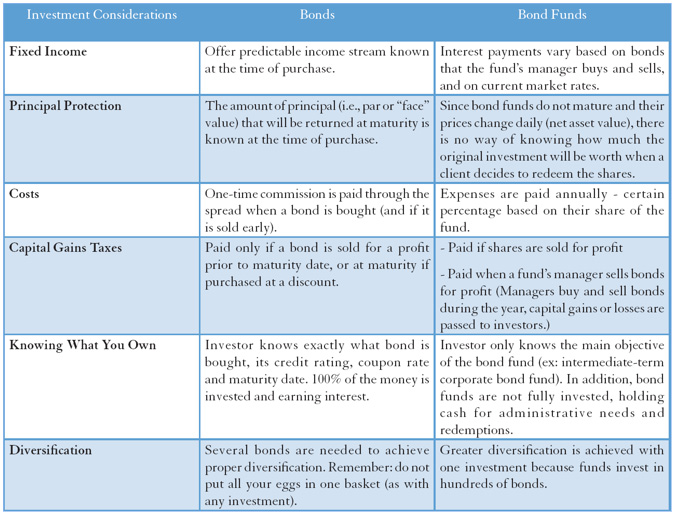

Whether to invest in individual bonds or bond funds is every investor’s personal decision based on your investment objectives, and factors that apply to your particular situation. Here is some information that might help you make an informed decision:

© April Dorey. Articles, statistics and other data referred to or cited are intended to provide readers with potentially useful information for their own personal use. *Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Reproduction without permission is permitted with due acknowledgement. The views expressed are those of the author, April M. Dorey, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Raymond James Ltd. is a member of the Canadian Investor Protection Fund.

For more information please contact:

April Dorey, B.Comm, FMA, FCSI

Financial Advisor

Raymond James

10th Floor, 1175 Douglas Street

Victoria, BC.

Tel. 250-405-2429

www.aprildorey.com