Current Article ∙ Archive ∙ Back to Island Voices

Timing is Everything: When to Take Canada Pension Plan Benefits

Approximately 93% of Canadian workers are covered by the Canada Pension Plan, and many more, including non-working spouses, are eligible for payments. In addition, according to Statistics Canada around 58% of the average retiree’s income in Canada comes from a combination of government programs: Canada Pension Plan (C/QPP), Old Age Security (OAS), and the Guaranteed Income Supplement (GIS).

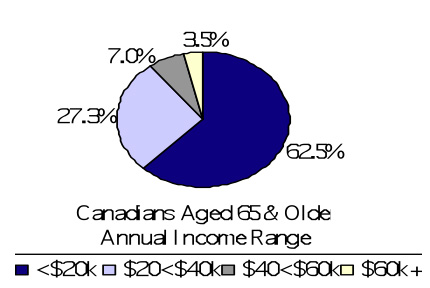

According to a recent study by Statistics Canada, disposable incomes for wealthier Canadians decline significantly after they head into their retirement years, but those with low incomes encountered relatively little change. However, that’s because an astonishing majority of Canadian seniors (aged 65 and older) lived on total incomes of less than $20,000.

Thus, for most individuals, deciding when to take Canada Pension Plan benefits will have a major impact on their abilities to live comfortably in retirement.

You Do Have A Choice

A comprehensive, clear and accurate understanding of your financial situation, both now and in the future, is essential. That understanding can only be gained through a thorough inventory, analysis and review of your requirements, circumstances and goals. Evaluate whether your core needs and lifestyle spending require you to collect that monthly Canada Pension Plan payment as soon as you retire or if you can afford to wait until you reach age 70, the point at which your benefits are maximized.

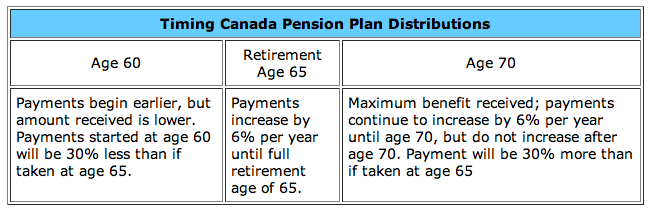

More than one-quarter of eligible Canadians take their benefits early – after they reach 60 but before they reach full retirement age – often because they simply don’t have a choice: they need the money. However, if you do have a choice, not collecting your Canada Pension Plan benefits, even after you reach your full retirement age, may make sense.

If you do not need to take your benefits early, we can help you determine when you should take them. For example, you can:

Wait until you reach your full retirement age before tapping into Canada Pension Plan or

Defer taking Canada Pension Plan benefits until you reach age 70, when you must begin taking them.

Key Factors Affecting Your Decision

Key Factors Affecting Your Decision

Before deciding when to begin taking Canada Pension Plan, you should consider a variety of factors. These include:

- Other sources of income: Work with a professional financial advisor to evaluate the tradeoffs involved in taking your benefits earlier and letting other assets grow untouched for a longer period versus dipping into other retirement assets immediately and deferring your Canada Pension Plan benefits.

- Your taxable income: Tax-related factors could also affect your decision. For instance, if your combined income from Canada Pension Plan and other retirement resources reaches a certain level, your tax liability may increase. Conversely, delaying Canada Pension Plan may reduce your taxes.*

- Your work history: If you have not worked a full 40 years and you begin taking Canada Pension Plan benefits early, those benefits will be less than had you worked the full 40-year period. The Canada Pension Plan provides no payments for the years you have not worked, reducing the annual benefits available to you. In this case, deferring Canada Pension Plan and working longer could be your best choice. Canada Pension Plan drops 15% of your lowest earning years and also credits years taken off for raising children under 7 years old when making calculations.

- Whether you plan to work in retirement: If you plan to work until your full retirement age, you probably won’t want to take benefits early. That’s especially true because, if your income is above a level set by Service Canada your other income security benefits like Old Age Security (OAS) and Guaranteed Income Supplement (GIS) will be greatly reduced or eliminated.

- Your health and life expectancy: Should you defer your Canada Pension Plan benefits until you reach 70, you will only reap the full advantage of doing so if you live past the age of 80. Of course, you can’t predict exactly how long you will live, but lifespans are increasing, and, if you are healthy, you may receive more benefits if you delay taking your Canada Pension Plan.

- Your spouse: If you are married, the needs and situation of your spouse are also vital factors in your decision. If you both have earnings from your work, you probably will both receive a monthly benefit. Married or common-law partners who are both at least 60 years of age, and receive their Canada Pension Plan (CPP) retirement pension can share the portion of their pension benefits earned during their time together. This may result in tax savings.

If your health or age is such that you are likely to predecease your spouse, you might want to delay taking benefits as long as possible in order to increase his or her survivor benefits. In today’s world, these benefits can be an important part of the survivor’s retirement assets, given that couples aged 65 have an 85% chance of least one of them living past 85. Note that the survivors are responsible for applying for benefits within 12 months of the date the contributor has deceased or risk losing benefits.

We’re Here to Help You

Although your Canada Pension Plan is very likely to be an important component of your retirement plan, keep in mind that it is only one piece of the puzzle. Canada Pension Plan is only designed to replace 25% of the earnings on which you paid into the plan. To gain maximum benefit from your retirement resources, it’s important to consult with a professional financial advisor to make sure you’ve considered all of your options and evaluated their implications.

The best financial decisions are based on informed reason, not emotion. If you would like to discuss your retirement plan, or if you have questions about the information provided, please feel free to contact me.

April M. Dorey, B.Comm, FMA, FCSI

T: 250.405.2429 or 1.877.405.2400

april.dorey@raymondjames.ca

www.aprildorey.com

*Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Written by April Dorey and expresses the opinions of the author and not necessarily those of Raymond James Ltd. Statistics and factual data and other information in this newsletter are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. Securities-related products and services are offered through Raymond James Ltd., member CIPF. Financial planning and insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member CIPF.

© April Dorey. Articles, statistics and other data referred to or cited are intended to provide readers with potentially useful information for their own personal use. *Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person’s situation. You should discuss any tax or legal matters with the appropriate professional. Reproduction without permission is permitted with due acknowledgement. The views expressed are those of the author, April M. Dorey, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Raymond James Ltd. is a member of the Canadian Investor Protection Fund.

For more information please contact:

April Dorey, B.Comm, FMA, FCSI

Financial Advisor

Raymond James

10th Floor, 1175 Douglas Street

Victoria, BC.

Tel. 250-405-2429

www.aprildorey.com